No fee crypto exchange

Get startedWondering where to buy and sell cryptocurrency or where to swap crypto commision-free?

Zero trading fees, maximum convenience

Trade fee-free on our reliable crypto exchange with the lowest fees, where possibilities to buy, sell, trade, and stake crypto shine like a sunny forecast.

Introducing LYFFE

Currency Grown With Care

$LFF utility token simplifies crypto for traders and businesses, making it easy and affordable for both to engage with blockchain.

Read our whitepaper

Our tools

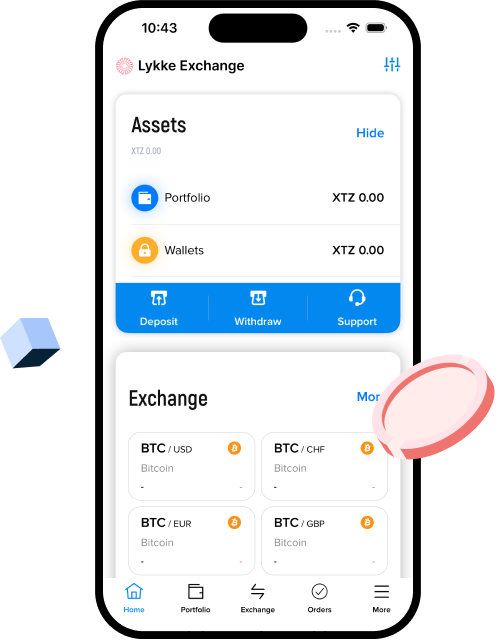

Exchange

ATTMO

weather forecast

ATTMO is a weather-inspired tool that generates potent crypto trading signals to help traders to optimise the timing of their trades and generate greater returns.

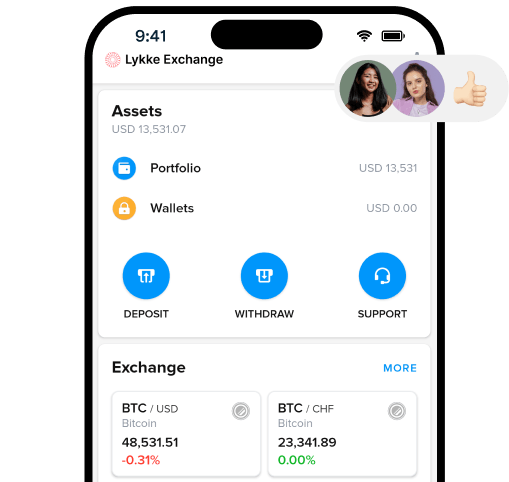

- Lykke offers an all-in-one free crypto trading platform with zero trading fees and low buy-sell spreads.

- We cover your fiat deposit and withdrawal fees, enabling you to trade crypto for free on Lykke.

- Enjoy solid liquidity, low spreads, and top-notch security with KYC and AML compliance standards.

- Accessible and efficient human support provides high-quality personalized service.

- Zero taker and maker fees, market and limit orders, and no hidden costs.

- HFT and algo trading friendly with 0% fees for API traders.

- Our robust infrastructure handles trading peaks seamlessly, ensuring a smooth trading experience.

- Easy onboarding: Just open an account and get verified in one day.

- Direct fiat on-ramp and off-ramp: Deposit and withdraw EUR, CHF, USD, and GBP by bank transfer without fees (except USD withdrawals).

- We offer some 20+ selected cryptocurrencies such as Solana (SOL) and Cardano (ADA) with liquidity and fiat-to-crypto or fiat-to-fiat pairs, and the list is growing! Lykke is the best Bitcoin (BTC) exchange and Ethereum (ETH) exchange popular amongst traders looking for the lowest fees.

- Very low trading limits. We admit users from 117 countries.

How much can I save trading with Lykke?

Try our tool to calculate and see for yourself why Lykke is not only the best cryptocurrency exchange but also the cheapest crypto exchange out there.

Much like the winds that shape a landscape, trading fees sculpt the profitability of a trading strategy and require understanding and management. Lykke's no-fee policy allows you to earn more from crypto markets.

Ready to start cryptocurrency trading?

Open crypto account and start trading crypto for free on Lykke, the best crypto exchange, today!